The Put/Call ratio measures the trading volume of put options to call options. It is an indicator which measures sentiment in the Options markets and thus can be used to gauge investor sentiment in the underlying Equity markets . As an example , a high volume of puts compared to calls indicates a bearish sentiment in the market , and vice versa .

It's believed by many market practitioners that certain extreme levels in the Put/Call ratio are good determinants of forecasting future market direction . A very high Put/Call level would indicate too much Bearish sentiment and would point to a reversal Bull rally in the market . Conversely , a low P/C level could point to an ensuing market sell-off .

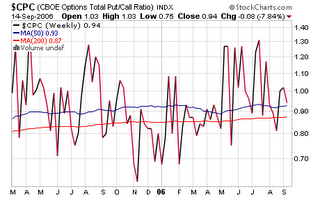

On days when the major averages perform strongly, the number of calls bought typically far outweighs the number of puts. On these days, greed prevails and the P/C ratio may be very low -- perhaps in the neighborhood of 0.70/1 . On days of deep market weakness, however, fear prevails and the number of puts purchased is generally far greater than calls -- possibly reaching 1.5/1 . While 1/1 might seem to be a neutral reading, usually more calls than puts trade on an "average" day. As such, a reading of around 0.80 is about "normal" on this indicator.

The daily P/C line is very uneven and most measurements need to be plotted over a moving average to smooth out the raw data , usually an average period of 10 days .

With the market's recent rally over these past 2 months , can we discern anything from today's Put/Call level ? A cursory glance indicates that Puts are still relatively high and may allow for further gains in the S&P500 . The sentiment may still mean that investors are very suspicious and cautious of the recent rally .......

It's believed by many market practitioners that certain extreme levels in the Put/Call ratio are good determinants of forecasting future market direction . A very high Put/Call level would indicate too much Bearish sentiment and would point to a reversal Bull rally in the market . Conversely , a low P/C level could point to an ensuing market sell-off .

On days when the major averages perform strongly, the number of calls bought typically far outweighs the number of puts. On these days, greed prevails and the P/C ratio may be very low -- perhaps in the neighborhood of 0.70/1 . On days of deep market weakness, however, fear prevails and the number of puts purchased is generally far greater than calls -- possibly reaching 1.5/1 . While 1/1 might seem to be a neutral reading, usually more calls than puts trade on an "average" day. As such, a reading of around 0.80 is about "normal" on this indicator.

The daily P/C line is very uneven and most measurements need to be plotted over a moving average to smooth out the raw data , usually an average period of 10 days .

With the market's recent rally over these past 2 months , can we discern anything from today's Put/Call level ? A cursory glance indicates that Puts are still relatively high and may allow for further gains in the S&P500 . The sentiment may still mean that investors are very suspicious and cautious of the recent rally .......

No comments:

Post a Comment