Thursday, September 28, 2006

Rate Cuts ???

Wednesday, September 27, 2006

Large Caps / Small Caps

Mid-Cap Index has returned 8.62%/year .

Mid-Cap Index has returned 8.62%/year .The pundits have called for Large Caps to start to outperform for quite a while now , to no avail , but things may start to change as the Large/Small cap chart is indicating

Friday, September 22, 2006

Killing Commodities

Thursday, September 14, 2006

Oil Inventories

As we have witnessed over the last 6 weeks , crude oil has fallen from $78/bbl . down to $63/bbl , a rapid decline and a major factor leading to the rally in Equities and Bonds . While we are happy to see retail gas prices falling from $3/gallon to $2.55/gallon at the pump , we shouldn't get overly optimistic that oil continues to fall towards $40/bbl. anytime soon.

As we have witnessed over the last 6 weeks , crude oil has fallen from $78/bbl . down to $63/bbl , a rapid decline and a major factor leading to the rally in Equities and Bonds . While we are happy to see retail gas prices falling from $3/gallon to $2.55/gallon at the pump , we shouldn't get overly optimistic that oil continues to fall towards $40/bbl. anytime soon. This week the IEA cut worldwide Oil demand to 84.7 Million bbl./day for the balance of 2006 , down from a previous estimate of 84.8 Million bbl./day made last May , and its 2007 daily Oil estimates was cut by 160 Thousand to 86.2Million bbl. /day --- not exactly huge declines . Recently OPEC cut worldwide demand estimates as well , also by token accounts .OPEC, which controls 40% of the world's crude, opted to keep its production quota at 28 million barrels per day to help lower prices and has maintained that level since July 2005 . For 2006 , OPEC expects demand growth in the U.S. to grow by only 90,000 barrels per day. In 2005, growth jumped by 230,000 barrels per day and in 2004 the growth was 520,000 barrels per day .

The increase of supply output , prospects of new Oil reserves in the GofM , and no Hurricane-related dislocations , have kept Crude and Gasoline prices under enormous pressure recently . BUT , that doesn't necessarily mean that the Demand side of the equation is fully eliminated . The U.S. consumer is still "addicted" to oil and Chinese demand is not going anywhere soon .

One way to look at the supply side is Total Oil crude and products in inventory which points to relatively high levels , but a better gauge to look at is the supply in storage needed to cover existing demand . In 1991 we had approximately 65 days of supply to cover demand , but in 2006 the supply is down to a lower level of 50 days supply to cover daily demand .

Put / Call ratios

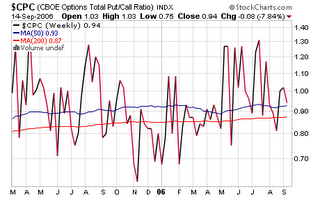

It's believed by many market practitioners that certain extreme levels in the Put/Call ratio are good determinants of forecasting future market direction . A very high Put/Call level would indicate too much Bearish sentiment and would point to a reversal Bull rally in the market . Conversely , a low P/C level could point to an ensuing market sell-off .

On days when the major averages perform strongly, the number of calls bought typically far outweighs the number of puts. On these days, greed prevails and the P/C ratio may be very low -- perhaps in the neighborhood of 0.70/1 . On days of deep market weakness, however, fear prevails and the number of puts purchased is generally far greater than calls -- possibly reaching 1.5/1 . While 1/1 might seem to be a neutral reading, usually more calls than puts trade on an "average" day. As such, a reading of around 0.80 is about "normal" on this indicator.

The daily P/C line is very uneven and most measurements need to be plotted over a moving average to smooth out the raw data , usually an average period of 10 days .

With the market's recent rally over these past 2 months , can we discern anything from today's Put/Call level ? A cursory glance indicates that Puts are still relatively high and may allow for further gains in the S&P500 . The sentiment may still mean that investors are very suspicious and cautious of the recent rally .......

Tuesday, September 12, 2006

Housing Futures

With housing prices declining some and inventories building , the Housing Boom seems to have halted and/or " popped " . The futures markets are presently indicating expectations of price declines for contracts going out as far as August of 2007

Quadruple Witching

With this Friday's Quadruple Witching ( contracts for stock index futures, stock index options, stock options and single stock futures all expire ) right around the bend , investors should take advantage of the week's volatility in "closing out " In-the-money positions and begin rolling them into new October , November and December positions .

The phenomenon of a Quad Witching has sometimes been referred to as "Freaky Friday" as it leads to many counter trends throughout the week leading into the final day of expiration . Aggressive accounts , usually hedge funds , proprietary trading desks and commodity funds are the most active players during this period and they need to weigh and rebalance their portfolios as certain positions come to a close . As they step up their activities , they try to " play " the diminishing option and futures premiums , yet tend to all rush out the exit at the same time . This action brings on severe swings in price and leads to some dislocations.

In taking advantage of this week we should focus on Implied Volatility and judge whether or not a stock's options and futures are priced appropriately for a "roll" or if the positions should be allowed to expire .

Sunday, September 10, 2006

M1

Friday, September 08, 2006

Stocks vs. Commodities

Friday, September 01, 2006

Fed Funds

With the Bond market continuing its rally , we need to judge where rates will be in the future to make a judgement as to whether or not they are overbought / oversold . The inversion of the Treasury curve , with 2-year Treasurys yielding 4.80 , 5-year yielding 4.71% , 10-year yielding 4.76% gives us information as to what the market is estimating .

Another place to look is the Fed Funds market . The Fed Funds yield is presently 5.25% after the Fed halted rate increases at its August meeting , and the forward contract prices are indicating no upward moves over the next 6 months . In fact , they're even hinting at a possible rate cut early in 2007 . At present they imply a 50% chance of a cut to 5% by the April meeting . With inflation figures cooling -- especially the Fed's favorite inflation gauge , the PCE-deflator @ 0.1% in August -- Fed Funds futures are a good place to judge where Treasurys are heading.